20 Aug “What Capital Position Is Right For You?” – Part II

PART 2 – DEFINING THE “LOAN MODEL” VERSUS “EQUITY MODEL”[1]

This post outlines considerations for the two major segments of a capital stack for a real estate project that will include EB-5 as a funding source:

- Debt– Either the Senior Loan or Mezzanine Loan position, or

- Equity– Notably, the Preferred Equity position. We leave aside the Common Equity position as it is rarely seen in EB-5 investment outside of the Direct Investment EB-5 (non-Regional Center) option.

There is much confusion in the EB-5 space relating to a simple question: “Are you investing in a Loan or an Equity Model

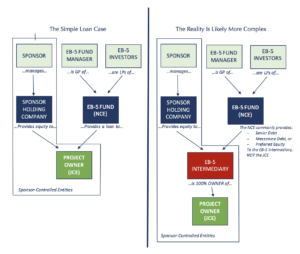

The chart below outlines the Simple Loan Structure as perceived by investors, vs. the actual structure, detailed under the heading “The Reality is Likely More Complex”.

The Sponsor is the company that is responsible for the development of the project, and the EB-5 Fund Manager is created by the Regional Center as the general partner of an EB-5 Fund set up specifically for that project. The major differences between the right-hand and left-hand sides are:

- The EB-5 Intermediary, which will be detailed below.

- The use of a Senior Loan, Mezzanine Loan or Preferred Equity to invest in the EB-5 Intermediary. The right-hand side (which is a chart entitled “The reality is likely more complex”) is meant to show the more complex structure that was recently introduced to the market by banks.

You, the investor, make a limited partnership investment into the EB-5 Fund, also called the New Commercial Enterprise (the “NCE”). The NCE contributes funds to an intermediate entity (the “EB-5 Intermediary”) that then puts money into the Job Creating Entity (the “JCE”). The Regional Center typically controls the NCE and the project’s developer typically controls the EB-5 Intermediary and the JCE.

On the left-hand side, “The simple loan case details the investment structure that many EB-5 investors believe is being used. However, this is a common misconception in EB-5 investments.

In the simple loan case, the NCE makes a direct loan to the JCE. This was the original “Loan Model.” Though the EB-5 investors were actually limited partners in a fund, the NCE was protected by a mortgage or equity pledge. Today, due to complex financing structures in real estate opportunities and regulatory limitations, direct NCE to JCE investment opportunities are limited. The actual structure is more complex, and more closely reflects what is outlined on the right side of the diagram.

Understanding the difference between a “Loan Model” and “Equity Model” is the key

The confusion that exists in the EB-5 marketplace on the “Loan Model” versus “Equity Model” today is driven by the right-hand side of the picture above given the existence of an EB-5 Intermediary Entity.

It is important to understand that EB-5 investors must make an equity investment; a return of the principal must not be guaranteed, and the initial investment must remain fully at-risk. You will hear Regional Centers say that you have the choice between a “Loan Model” and an “Equity Model,” which feels to be contradictory; how can an investor make a loan when he or she must make an equity investment?

In most cases today, the “Loan Model” refers to a structure where the EB-5 investors become limited partners in an NCE that will in turn make a Mezzanine Loan to the EB-5 Intermediary. The EB-5 Intermediary then provides those funds to the JCE as equity.

You are not a lender in the traditional sense:You are investing in a debt fund;.

In the “Equity Model” you, the investor, are a limited partner in an NCE that makes a Preferred Equity contribution to the EB-5 Intermediary which then invests the money in the JCE as equity. This is the same as investing in a private equity fund that offers Preferred Equity to developers.

To summarize:

The “Loan” model typically means that you are a limited partner in an entity that makes a Loan to an intermediary that then invests the money into the project entity as equity.

The “Equity” model typically means that you are a limited partner in an entity that makes a Preferred Equity investment in an intermediary that then invests the money into the project entity as equity.

In Part 3 we will address the structures of the Loan Model and Equity Model, and why we at AscendAmerica choose the Equity Model today.

[1]The information included in this blog post is for informational purposes only and not for the purpose of providing legal advice. You should contact your attorney to obtain advice with respect to any particular issue or problem. This is neither an offer to sell nor a solicitation of an offer to buy any security, which can be made only by the Confidential Private Placement Memorandum and all exhibits, attachments and supplements thereto and sold only by participating broker-dealers who are licensed to do so. Nothing contained in this article constitutes legal, investment, tax or other advice, and you should not rely upon it in making an investment or other decision. The opinions expressed herein or throughout this website are the opinions of the individual author and may not reflect the opinions of AscendAmerica or any of its officers, directors or employees.